Investor Experience Index: The Role of Anonymity in Investor Feedback (Q1 2025)

In analyzing review patterns from retail real estate investors, a striking relationship emerges between rating sentiment and reviewer anonymity. While all reviewers on the Invest Clearly platform are verified, individual investors can choose whether to display their names publicly. This choice reveals a compelling pattern about how retail LPs provide feedback.

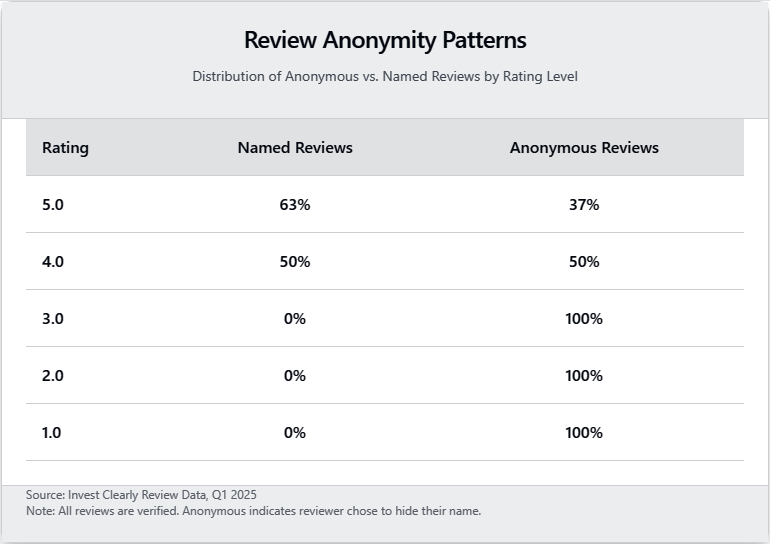

The data shows a clear correlation between review sentiment and anonymity preference:

- 100% of reviews rating 3-stars or below are submitted anonymously

- Only 37% of 5-star reviews are anonymous

- Named reviewers exclusively provide 4 or 5-star ratings

This stark pattern manifests in the overall metrics:

- Named Reviews Average: 4.97/5.0

- Anonymous Reviews Average: 3.84/5.0

The disparity extends beyond just overall ratings. Anonymous reviews show consistently lower scores across all metrics:

- Pre-investment Communication: 4.39 vs 5.00

- Post-investment Communication: 3.95 vs 4.96

- Leadership Assessment: 3.77 vs 4.99

- Expectation Alignment: 3.63 vs 4.94

This pattern suggests a fundamental dynamic in the retail investor-sponsor relationship: individual investors appear hesitant to publicly criticize sponsors. The data implies that anonymity serves as a crucial mechanism for surfacing honest, critical feedback in an industry where individual investors might feel vulnerable about potential repercussions or future investment opportunities.

For sponsors, this insight has important implications. Anonymous feedback channels might reveal more candid assessments of their performance, particularly from retail investors who might otherwise remain silent about their concerns. For prospective investors conducting due diligence, it suggests that examining both anonymous and named reviews provides a more complete picture of sponsor performance.

The findings raise broader questions about transparency and feedback in private real estate investment: Does the power dynamic between retail investors and sponsors inhibit open communication? Are current feedback mechanisms adequately protecting individual investors while encouraging honest feedback? The data suggests that anonymous review options play a crucial role in surfacing the full spectrum of retail investor experiences.

Written by

Invest ClearlyOther Articles

What Is a Capital Stack?

Every real estate deal needs funding, which is why real estate syndication and private equity investments have become so widespread. However, where that money comes from and in what order it gets repaid isn't random. It's structured carefully, layer by layer, in what's known as the capital stack.

Power of Community in Passive Investing | Brian Davis

Brian Davis shares how Spark Rental's co-investing club vets deals, evaluates operators, and helps investors build passive income

What is a Capitalization Rate in Real Estate

Learn about cap rates, how they are used in commercial real estate, and how investors should consider them when evaluating passive real estate investments.

Evaluating Real Estate Sponsors: The Role of Social Proof in Investment Decisions

This article explores the role of social proof in evaluating real estate sponsors, the risks of relying solely on past returns, and the dangers of influencer marketing in investment decision-making.

What is a Syndication Real Estate Investment?

A real estate syndication is a common investment structure that pools capital from multiple investors to acquire and manage larger commercial real estate assets.

Using AI, Community, and Transparency to Build a Better Investment Firm with TJ Burns

TJ Burns, founder of Burns Capital and ex-Amazon engineer, joins the Invest Clearly Podcast to break down the real challenges of raising capital and building long-term LP trust.