Power of Community in Passive Investing | Brian Davis

Brian Davis, former landlord turned full-time LP and co-founder of SparkRental’s Co-Investing Club talks about what really matters when evaluating passive real estate deals.

Brian shares the mistakes that made him quit landlording for good, the red flags he watches for in sponsors, and why great property management can save a sinking deal. He also pulls back the curtain on how Spark’s 300+ members vet deals together and why dollar cost averaging isn't just for stocks — it's a powerful mindset for real estate investing, too.

This episode is packed with insights about passive investing, deal screening, operator due diligence, and why “conservative underwriting” is often just marketing fluff.

Podcast Transcript: Brian Davis on Passive Real Estate Investing

Pat Zingarella (00:00) Brian, thank you very much for joining us. Back in my corporate life, out-of-office messages were extremely common when people would go on vacation. But when I started emailing you during your time off, it was some of the coolest stuff I've ever seen. Messages like "I'll be back on this day. I'm currently scuba diving off the tip of South Africa with my son and will only be answering emails." I thought, "This is awesome." So why don't we take a couple seconds for you to introduce yourself?

Brian Davis (00:44) My name is Brian Davis. I've been in real estate investing for over 20 years. I fell into it by accident out of college, working for a hard money lender. My passion right now is organizing a club of other passive real estate investors to get together, vet deals together, analyze risk together, and go in with smaller amounts than you'd have to otherwise. My partner and I did this because that's what we wanted for ourselves, for our own investments.

I feel that the best businesses come about because the founders see a need that they themselves need met. So they say, "We don't see anything else out there in the world that's doing that. Let's create it ourselves." That's what we're doing right now. And to your point about the away messages, I just got back a few days ago from a trip to the Amazon with my four-year-old daughter. We went with another family that has a kid her age. My away message was "I'm eating grubs in the Amazon. I'll get back to you on Monday."

Pat Zingarella (01:42) That's so cool. Are you full-time with Spark? Would you consider yourself a full-time passive investor?

Brian Davis (01:52) The business, Spark Rental, is my full-time focus. I'm a full-time entrepreneur running that business alongside my business partner and some employees and contracted workers. I also have a side hustle doing freelance writing about investing, personal finance, and real estate, which started many years ago when we were trying to get Spark Rental off the ground. We ran out of money, so we needed to extend the runway. I started freelance writing on the side and found that I really enjoyed it. So I kept doing it long after Spark Rental became profitable, and it helps my wife sleep at night, which is always nice.

Pat Zingarella (02:28) You see a lot of clickbait posts about achieving financial freedom through passive investing and retiring off of it. It seems like you're actually doing it - living the life beyond just making the investments. Would you agree that this actually set you up for the financial freedom some people are chasing?

Brian Davis (02:54) I don't consider myself to be financially independent at this point. If we didn't have a daughter, maybe I would consider myself financially independent. But one of the things that has changed for me over the years - I used to be a pretty diehard FIRE movement guy, and I still believe in the basic tenets of having a high savings rate and building your net worth and passive income as quickly as you can. But I'm not so much chasing that idea of sitting with piña coladas on a beach for the rest of my life. That would get really boring, and you'd just become a fat alcoholic with a sunburn if that's how you spent the rest of your life.

To me, it's more about having work freedom - being able to do the kind of work that lights you up, that makes you excited to get out of bed in the morning, even if you have an alarm going off. But of course, if you have work freedom, you don't have to set an alarm necessarily. So the idea of being able to pursue work that is meaningful to you, that's fulfilling, even if it doesn't pay a massive amount of money - that to me is the ultimate goal and what should really replace that whole notion of FIRE and living on a beach.

Because at the end of the day, you would just get bored doing nothing, especially if you retire in your 30s or 40s, or even your 50s. So the idea of going out and having control over the work that you do and doing work that really excites you, I think that really should be the goal. Build the net worth, build the passive income streams. One of the things that I wrote about in our newsletter last week was that this long weekend trip that my daughter and I took to the Amazon, we were able to pay for that entire trip with a fraction of our passive income for this month. That's the kind of stuff that's fun, but it's not really about sitting on a beach. It's about holistic lifestyle design.

Pat Zingarella (05:06) I'd love to learn more about your portfolio and how you guys make investment decisions. With today's environment, are you still actively placing capital or are you in wait-and-see mode?

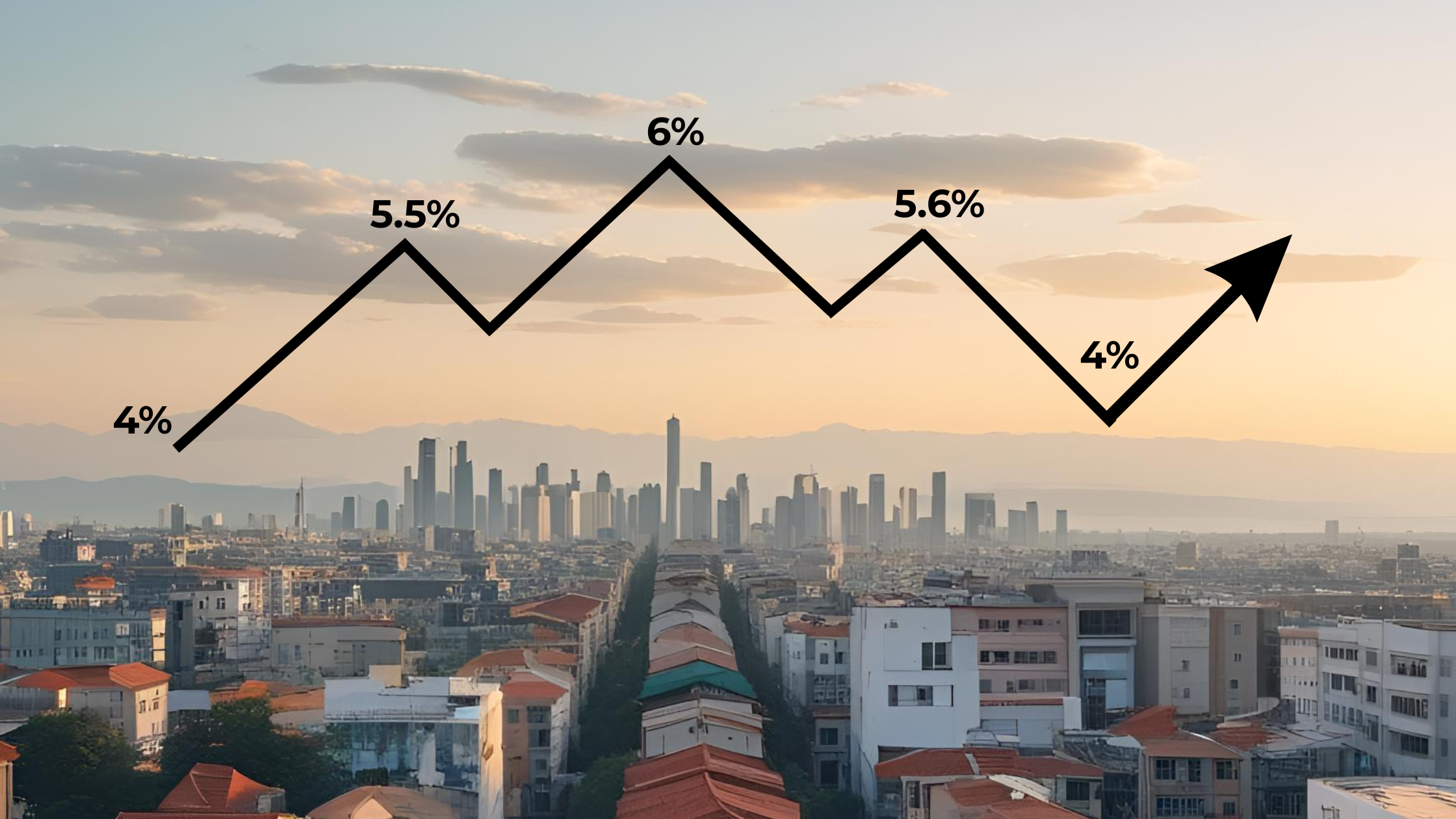

Brian Davis (05:21) We meet every month as an investment club and we vet a new deal, sometimes two deals in a month. So we're very much investing right now. I actually don't think that it's a bad time to invest. Now, let me preface that by saying that I am very much opposed to the very notion of timing the market. Every time that I have tried to get clever with my investments, whether that's timing the market or trying to pick the next hot stock or the next hot asset class or the next hot market, I've just been totally bulldozed by life.

Even when I was right, I ended up being wrong somehow. For example, there was a big boom in marijuana stocks back 12, 13, 14 years ago. I saw that coming, but I was too early in it. So I put all this money into pot stocks as a 20-something thinking that I was going to be clever. Even though the thesis was right, I was too early and all the companies that I invested in got knocked out before the big surge in those stocks. Even when you're right, you're usually wrong when it comes to your actual results and investments.

So I don't try to time the market anymore. I think it's a fool's game. You have to be right twice - you have to be right at the entry point and you have to be right at the exit point. At this point, I practice dollar-cost averaging with my stock investments and my real estate investments. That is part of what we're trying to do in this club - just small investments every single month, keep participating in the market. In our club, the minimum investment is five grand. Collectively we'll be investing half a million bucks, 600 or 700, 800 grand, but each person can invest five grand. That makes it way easier to practice that dollar-cost averaging.

I invest every month in these investments myself. This is very much something that my partner and I wanted to do for ourselves, for our own investments too. I don't think it's a bad time to invest right now. It is a gloomy mood, especially in multifamily and in office space, but gloomy moods are usually the best time to buy in, as opposed to the euphoria when everyone's shooting off the party poppers, like in late 2021, early 2022, when multifamily and real estate syndications in general had just done great for the last few years. That was a terrible time to invest - interest rates were about to go through the roof. All these operators were about to get totally crushed on their variable interest debts.

So the mood was great, but it was actually a terrible time to invest. The mood is pretty sour right now and has been sour for a couple of years. Maybe it's not such a bad time to invest. What's the saying? "Buy when there's blood in the streets." But don't time the market. So throw everything I just said out the window.

Pat Zingarella (08:58) I'd love to learn more about the process of deal selection in Spark. One thing I've seen people get caught up on over the last couple of years, maybe a form of confirmation bias - as a deal comes in and you're underwriting it, how do you think about it when the majority is interested in this deal versus when the majority thinks it's a bad deal? How do you individually think about that process?

Brian Davis (09:49) My partner and I select the deals each month for our co-investing club. What we'll do is bring in the operator to give a quick summary of the deal and then open it up to Q&A where we all grill the operator together as a club. Then the operator will hop off the call and we'll have an internal club discussion about what we like about the deal, what we're concerned about - pros, cons, risks, all that kind of stuff.

My partner and I only pick deals that we want to put our personal money in. We will pre-vet these deals - we do our own due diligence before we decide to feature them in our co-investing club. Our club at this point is investing between roughly 400 and 850 grand a month in these deals. But I decide that I'm going to invest before we feature the deal. So for me personally, that decision's already been made.

But it is really useful to hear other people's thoughts and reactions, to hear the questions that they throw at the operator. Inevitably, there are some great questions that hadn't occurred to me that our members are asking, and that is part of the beauty of vetting these deals together as an investment club, as opposed to just going it alone. People are going to come up with really great questions or perspectives or extra data points that hadn't occurred to you.

Sometimes that's geographical. We'll have a member say, "Hey, I live five minutes down the street from this building, pass it by on my commute every day, and I can tell you XYZ about this neighborhood or about this property." That's really useful. Or we'll have people with niche knowledge. We have a woman in our club who works in the insurance industry. So she's always picking apart the insurance quotes and especially the projected insurance increases over the performance stuff. You get the hive mind.

As far as my partner's and my selection process, we want to look at risk from as many different angles as possible. We'll look at the debt structure, for example - how much runway is there? Is there some kind of rate protection in place? Whether it's a rate swap or a rate cap or a fixed interest rate. We will look at things like property management risk. That's a big one. How many properties has this operator worked with the property manager on before?

Pat Zingarella (12:33) That's your background, right? You were in property management in the past or were you an active investor?

Brian Davis (12:38) I was an active landlord and rental investor throughout my 20s and early 30s. So that is where my active investing background came in. I did flip a property or two and I did a little bit of multifamily stuff, but it was mostly single family rental investing that I was doing. It turned out I hated being a landlord, which is why I'm not a landlord anymore and I only invest passively.

But property management is super critical. My experience as a landlord really reinforced that. I made every mistake in the book as a landlord and rental investor. I was buying in very low-end neighborhoods and found that I couldn't get good property managers to manage these properties. That was a tough lesson - I bought these properties and figured I'll just hand them off to a professional property manager and they'll do a great job for me. But it turns out that the really good professional property managers aren't going to take low-end properties because they have three times the headaches and they bring in a third of the fees for the property manager. So why would they take them if they have a choice? You're left with the dregs, the bottom of the barrel for property management for those types of properties.

So with syndication deals, for example, how many properties has this team, this property management team worked with this operator on before in that market? If it's an operator who's going into a new market and they've never worked with the property manager before, that's a big red flag for us. If it's an operator who's done nine deals in that market, working with the exact same property management team, that's great. We love that stuff.

I've seen this many times where bad property management can really sink an otherwise sound deal and vice versa. I've seen really great property management keep a deal afloat that really has no business staying afloat. They managed to keep the occupancy high and they managed to keep the retention high and they managed to hold it together even though the deal had otherwise kind of fallen apart.

Same thing with the construction side. How many deals has that construction team worked on with this operator? Same concept there. Obviously, experience is a big one. Track record. We want to get a sense for the market risk of the deal. How conservative is the underwriting? Every operator says that their underwriting is conservative, so you have to pick through and really put that to the test and see how you feel about it.

Pat Zingarella (15:40) How many deals would you say you're looking at to find one worth presenting? And then how many deals does everyone look at to find one worth investing in? What's that funnel look like for you?

Brian Davis (15:54) We have deals constantly coming across our desk. That's part of the value that my partner and I are bringing to the club - we network with operators all the time. So we're constantly getting on the phone, meeting with new operators, meeting with operators who maybe we met with a year or two back, but we haven't talked to in a while, and just seeing how they're doing, what's going on with them and their properties.

Obviously we get on their investor email lists. So these deals are just constantly flowing into our inbox. We have a little sub-folder in our main inbox. When we're starting to look for the next month's deal, we'll go in there and start picking through these deals and seeing which ones we like. If there's an operator who we haven't worked with in a while, but who we like a lot, maybe we'll reach out to them and say, "Hey, what's in your pipeline? What's coming up?"

One of the things that we do is we try to reach out to smaller operators who aren't necessarily syndicators and partner with them. People that investors would not have found on their own necessarily - that is really important to us. We want to bring some kind of niche deals to our club that people aren't going to just find on their own or by banging around in BiggerPockets forums.

We love doing little private partnerships with more mom-and-pop operators. For example, we've partnered with a house-flipping company that operates in Michigan. They're not syndicating deals, they're not really raising money from the public at large. But we got introduced to them by someone that we trust and we've done a few investments with them and partnered with them on some flips. Same thing with a spec home developer in Texas. We've partnered with him on some development projects, land flippers, stuff like that.

Pat Zingarella (17:56) I recently had Layla Khoumoum on, and we were talking about the trends she's seeing now compared to a year or two ago. The big one was deal flow seems to be down by a factor of three to four, but they're more conservative, but she's noticing cash flow is a lot tighter now. Are you noticing any trends with deals that are coming across your desk now versus a year, two, three ago?

Brian Davis (18:28) There are definitely way fewer deals than three years ago. And that's probably a good thing. To your point about the quality of deals improving, operators have tightened up their underwriting. The average operator has gotten more conservative with their underwriting by necessity, and that's good for the entire business. Again, that's one of the reasons why I feel like now is not such a terrible time to invest, despite the doom and gloom that you see in the headlines. I think operators are underwriting much better, much more conservatively now than they were even two years ago.

As far as cash flow, we're still seeing some good cash flow deals. We do like cash flow deals in general in our club. We find that our members are reassured by those steady distributions and the higher yield and getting their hands on some of the returns in year one instead of having to wait five years before they see a cent. We do invest in growth deals as well, but in general, we like the cash flow deals.

You can see some of the glimmers of my past as a rental investor in some of that where I think it's easier to underwrite for, it's easier to project out cash flow than it is to project out profits from appreciation. Appreciation is somewhat speculative. Cash flow, you can measure right now today. So it's easier to project your operating expenses out over the next couple of years and rent hikes out. That's all pretty easily projected. Where exit cap rate is going to be in five years from now, who can say? No one knows that.

As far as trends about what we're seeing today, definitely fewer deals, better quality underwriting. There's that quote, I think it's Warren Buffett who said, "When the tide goes out, you can see who's been swimming naked." We've definitely seen that. Some of the operators who had just sterling reputations a few years ago, they're on our blacklist now. We won't invest with them. And so is anyone who goes on Invest Clearly, for example, and actually checks out these operators.

I do think that the blood in the streets has cleaned up the industry some. It's knocked out some of the players who were playing a little too fast and loose. So I do think that it's not a bad time to invest because of all those factors. But we're still seeing plenty of deals. There is no shortage of deals out there. We think that you can find very good quality deals right now if you do your due diligence.

Pat Zingarella (21:23) We talked about how you underwrite deals. One thing we really focus on at Vescoly is the operator. What has the experience actually been beyond some of the marketed or targeted returns? How do you think about evaluating not just the horse, but the jockey as well?

Brian Davis (21:45) I do think that there is a lot of truth in that saying in the industry - bet on the jockey, not the horse. So we underwrite operators first and foremost, before we'll look at a single one of their deals. As far as vetting operators, first and foremost, we want to get a sense for their experience level.

There are operators who I know personally, people who I'm friends with and have a personal relationship with, who have come to me with deals. The deal itself might look great. But if they've only done a couple syndication deals, even though I like and trust them as a person, they just don't have enough experience for me to feel comfortable bringing those deals in front of the 300-some members in our co-investing club and putting our stamp of approval on it and attaching our name to it. Not as a co-sponsor - we don't co-sponsor deals - but just in general.

So we generally want to see someone who's done at least five syndication deals and other real estate deals before they started syndicating, whether that's smaller multifamilies that they bought by themselves or with JVs with other people. We want to see a solid track record of experience. Ideally, some deals that have gone full cycle, although that's not a prerequisite for us to consider somebody.

We're actually doing a bonus deal right now in our club with an operator who's done nine deals total and a bunch more before they got together as partners for a syndication firm. None of those nine deals have gone full cycle, but those deals are performing well. They're cash flowing well, they're ahead of projections. So we feel perfectly comfortable investing with them. Some of the operators we've invested with - the other one that we did earlier this month actually was with an operator who has done 145 syndication deals. Dozens of those have gone full cycle. It's nice to work with people with that much experience under their belt. Obviously most operators don't have that kind of experience.

Experience is important, but trustworthiness is a big one and that's a lot harder to quantify than experience. So sometimes it takes a few conversations with operators and letting those conversations freewheel a little bit, kind of letting them meander and see where they go. Obviously we ask a lot of targeted questions, but we also want to just have a flowing conversation and just get a sense for them as a person, how they treat their investors' money versus their own interests.

We want to see people who put their investors' interests ahead of their own. We always ask operators about, "Tell us about deals that have gone badly for you. Tell us what went wrong, how did you handle it? How did you communicate that to your investors?" One of the things that we do is we go on platforms like Invest Clearly, like Passive Pockets, and we will look at independently verified reviews from LPs for these deals.

We want to see what other LPs are saying about these deals. Often we will ask the operator to connect us with LPs who have invested with them on multiple deals and hop on a quick phone call with them and just get a sense for how it's been for them. Not just how the deals have performed, but how has the operator communicated? How do you feel about the way they're managing these properties? Again, just trying to connect as many data points as you can, both qualitative and quantitative, to paint that full picture about the operator.

Pat Zingarella (25:39) When you ask the question, "Tell me about a deal that may have gone poorly," do you feel like you get genuine honesty or do you often feel like it's like the interview question, "Tell me your greatest weakness" that you spin into a positive message? How do you feel about that?

Brian Davis (26:03) Every operator has made mistakes and has had deals go awry on them in some way or form. And if they haven't, then they don't have enough experience, and then we don't want to invest in them anyway because they haven't done enough deals. So I actually think it's a really telling question, or rather their answer to that question is pretty telling. That is how you can help separate out investors who you do versus don't want to invest with.

Good answers to that question will say, "Hey, this thing happened that we weren't prepared for and that we didn't properly vet for, and that's a mistake that we made once, and now we vet for that. And this is what we had to do. We had to suspend distributions for three quarters or whatever it was. Or we had to exit that deal at a slight loss, but we were able to give all of our investors their full money back and we took that hit." That is a pretty good answer to that question, I feel like. But to your point, sometimes people will have an overly polished answer to that question that makes me nervous and makes me hesitant to invest with them.

Pat Zingarella (27:17) I'd like to learn more about Spark. I saw you don't have to be accredited to join. I'd love to learn more about actually getting involved, the process and things like that.

Brian Davis (27:40) It's super simple. We are a flat fee membership business. It's $59 a month or $497 a year to be a member in the Co-Investing Club. We will vet a deal together every month. We'll host a meeting and sometimes two deals a month, but one is what we're promising. We also get together for a separate educational call every month as well. Often we'll bring in an outside topic expert to speak about things like tax strategies for passive real estate investing or something like that.

We'll form a joint LLC for each deal. Any members who want to invest in that month's deal can do so with $5,000 or more. They get listed as an owner in that joint LLC proportionate to what they invest. My partner and I do not get any kind of cut of the investment amount. We don't get an extra split or anything like that. We are not a fund of funds. We are not co-sponsoring deals. So all the returns pass straight through to the joint LLC. I invest personally in every deal or at least thus far I've been able to do so. So far I've been able to invest in every single deal personally as just one more member of the Co-Investing Club.

We set up a joint bank account for these LLCs and everybody gets view access to that joint banking - no one can go in and raid the account. But everyone gets access to view the bank account and see every transaction. So people can see as distributions come into the joint bank account, they can see when the big wire goes out to the operator and they can see every transaction. So full transparency. Everyone gets access as basically a joint venture partner. And then the LLC forms a single LP in that deal.

For the operator, they get to work with one entity, one LP. They can send one K-1 and send one email update to us. We just forward out those email updates to all of our members who participated in that deal. And when we get a K-1 for the joint LLC, our accounting team will divvy that up and send individual K-1s out to each person. That does cost money, but we just share those costs as a joint LLC. It's $75 per year for members in that LLC.

Pat Zingarella (30:11) I have one more question for you before we wrap up. What is one thing in passive investing that you think needs to die?

Brian Davis (30:24) Novice people who are first getting into it have a lot of preconceptions that I think are wrong and they're going to get them into trouble. One of those is - a lot of people who get into passive real estate investing come from being an active real estate investor, maybe buying rental properties like I used to, and they have this notion carry over from that that your investment's not going to go to zero and that maybe you could lose a little bit of money or you're not going to get the same returns, but it's not going to go to zero, you're not going to lose everything.

That's not true. You can absolutely lose 100% of your investment in a passive investment because you're part of that common equity at the very top of the stack. So a property doesn't have to drop to $0 in value for you to lose 100% of your investment capital. Common equity makes up 15% of the ownership of a property and that property drops by 15%. Guess what? You've lost everything. So that's one misconception that needs to die for novice passive investors.

But industry-wide, there are too many operators who are in this for themselves. They're in it to get rich themselves and to make money rather than to make their investors rich. So it's one of the things that we look at when we're vetting deals and vetting operators - how do they structure their fees? When do they get paid? How do they get paid? And do we as LPs feel like our interests are being put ahead of theirs in the investment or the return breakdown structure?

Pat Zingarella (32:12) Brian, thank you so much. Where can people find more about you and Spark?

Brian Davis (32:18) SparkRental.com. And you can check us out on all the social platforms at Spark Rental. You'll see our Co-Investing Club front and center on our website. Check it out, see how it works. We have a very generous refund policy, by the way. We know that this is not for everybody. This is a niche thing that is great for some people, but maybe not for most people. So come join the club, attend a few meetings, see how it works, see how the deals work, see how you like them.

And if it's not for you, if you're not feeling it, drop out with a full refund. We only want people in this club who are excited about it and want to be here and want to invest. And if that's not you, that's totally fine. We'll refund your club membership dues and maybe we'll see you again in a year or two. We want to work with people who are really excited to be doing these kinds of investments.

Pat Zingarella (33:08) Brian, thank you so much.

Brian Davis (33:10) Pat, this was a lot of fun. Thank you so much for having me.

Written by

Invest ClearlyOther Articles

What Is a Capital Stack?

Every real estate deal needs funding, which is why real estate syndication and private equity investments have become so widespread. However, where that money comes from and in what order it gets repaid isn't random. It's structured carefully, layer by layer, in what's known as the capital stack.

What is a Capitalization Rate in Real Estate

Learn about cap rates, how they are used in commercial real estate, and how investors should consider them when evaluating passive real estate investments.

Evaluating Real Estate Sponsors: The Role of Social Proof in Investment Decisions

This article explores the role of social proof in evaluating real estate sponsors, the risks of relying solely on past returns, and the dangers of influencer marketing in investment decision-making.

What is a Syndication Real Estate Investment?

A real estate syndication is a common investment structure that pools capital from multiple investors to acquire and manage larger commercial real estate assets.

Using AI, Community, and Transparency to Build a Better Investment Firm with TJ Burns

TJ Burns, founder of Burns Capital and ex-Amazon engineer, joins the Invest Clearly Podcast to break down the real challenges of raising capital and building long-term LP trust.

The 'Institutional' Tax: Are You Paying a Premium for Prestigious Partners?

For LPs navigating an increasingly complex private real estate landscape, understanding when institutional backing genuinely adds value - and when it merely adds cost - is vital to optimizing your allocation strategy and maximizing risk-adjusted returns.