Network Bias: Why Your Trusted Contacts Could Be Your Biggest Risk

By Shane Pogue

The Comfort Trap

Investors love warm referrals. A deal introduced by a trusted contact feels safer than one from a stranger, and sometimes it is. But trust is not a substitute for verification.

Some of the biggest frauds and financial disasters have happened because investors skipped due diligence on a “friend of a friend.” It’s an easy trap to fall into, after all, if someone in your network vouches for an opportunity, why wouldn’t you trust them?

Yet, history shows that some of the most damaging investment losses occurred precisely because investors relied on word-of-mouth validation instead of independent verification.

Due diligence isn’t just a “nice to have” addition to your risk management strategy, it’s the only way to operate safely. A strong network is an asset, but blind trust can turn it into a liability.

The Blind Spots of Trust-Based Investing

One of the biggest dangers in investing is the illusion of safety. Just because someone is “known” within your network doesn’t mean they are legitimate.

Fraudsters thrive on social proof. They often embed themselves in professional and investor circles for years, strategically building credibility before executing their schemes. The tighter the circle, the easier it is for a bad actor to exploit referrals, reputations, and personal connections to gain credibility.

Social proof is a valuable tool when used alongside due diligence, helping investors gauge credibility through reviews, track records, and verified insights. But fraudsters also understand its power and can manipulate unverified social proof to build trust. They infiltrate investor circles, gain endorsements, and use reputation to bypass scrutiny. The key is distinguishing trustworthy, transparent social proof from blind reputation-based trust.Verified, transparent sources of social proof, such as independent reviews, deal history, and track records, can be valuable tools when combined with due diligence. The key is to separate earned credibility from manufactured perception.

This is why network bias is so dangerous, it replaces data-driven due diligence with trust based investing, leaving investors exposed to risks they never see coming.

Case Studies of Network Bias Gone Wrong

- Affinity Fraud: Some of the most infamous Ponzi schemes (like Bernie Madoff’s) thrived because investors trusted their social and professional circles more than independent vetting. Madoff leveraged his reputation within exclusive networks, country clubs, wealth managers, and financial institutions, to defraud investors out of billions.

Lesson: Social proof is not proof. Always verify financials and legal history, even when someone comes recommended by a trusted source. - Real Estate and Private Equity Risks: Investors have lost millions by skipping due diligence simply because a colleague vouched for a deal sponsor or operator. A notable example is the DC Solar Ponzi scheme, where Jeff Carpoff’s fraudulent $1 billion investment scam ensnared even major institutional investors.

Lesson: Due diligence is best practice, not optional. Always perform it early and throughout the course of a relationship to hold all parties accountable. - The “He’s a Great Guy” Fallacy: Too often, character assessments based on reputation replace financial, legal, and operational scrutiny, leading to devastating losses. Even seasoned investors with strong intuition can be deceived by charismatic fraudsters.

Lesson: Intuition is valuable, but data is more reliable. Verify financial records, legal history, and operational track records before trusting someone’s reputation.

How to Protect Yourself

- Separate Trust from Verification – Run the same due diligence on a referred contact as you would on a cold deal. A warm introduction does not mean a free pass. This will save you from potential losses, especially if someone has infiltrated your professional networks in the past.

- Investigate Relationships – Look for conflicts of interest, past failures, and undisclosed liabilities. Just because someone is well-connected doesn’t mean they are risk-free. All investments come with risk, so if someone tells you otherwise, that’s a red flag.

- Leverage External Due Diligence Experts – Independent due diligence removes blind spots and ensures objective verification, no matter how trusted the source.

Smarter Networks, Safer Investments

Your network should be an asset, not a liability. Don’t rely on surface-level checks or assume your network can replace the work of trained professionals.

The best investors balance trust with verification, strong relationships and rigorous due diligence can (and should) coexist. Trust must be built on a foundation of verifiable facts.

And remember, if someone is offended by being vetted, that’s a red flag in itself.

Takeaways

Deep due diligence is not just best practices, it is a necessity. It is not an optional step in risk management but a core part of protecting your investments.

A warm referral does not replace independent due diligence. Referrals are valuable, but they should not be mistaken for verification. If an individual has never been vetted, or if it has been a while since they were last reviewed, another check is warranted.

Due diligence is an ongoing process, not a one-time event. Constant monitoring and repeated checks ensure that investors remain protected, especially as circumstances change.

Fraudsters rely on social proof to infiltrate trusted networks. Once embedded, they leverage these relationships to gain credibility before striking, often causing widespread financial damage and chaos.

Affinity fraud is common in real estate, private equity, and investment circles. Always verify before investing. Just because someone is part of your network does not mean they are trustworthy.

Verify and vet anyone offering investment opportunities within your network. Even well-intentioned contacts may unknowingly introduce bad actors. Trust, but verify.

Red flags include guarantees of “low risk” or “no risk” deals and reluctance to provide documentation. Any legitimate investment comes with paperwork. If someone is unwilling or unable to provide it, consider that a serious warning sign.

The foundation of trust in business and investing is verification. If someone objects to being vetted, that alone is a red flag.

A trusted introduction may open the door, but due diligence ensures you’re not walking into a trap.

Written by

Shane PogueFounder of Aegis RSI, helping investors & businesses mitigate risk, avoid fraud, and make confident decisions.

Other Articles

What Is a Capital Stack?

Every real estate deal needs funding, which is why real estate syndication and private equity investments have become so widespread. However, where that money comes from and in what order it gets repaid isn't random. It's structured carefully, layer by layer, in what's known as the capital stack.

Power of Community in Passive Investing | Brian Davis

Brian Davis shares how Spark Rental's co-investing club vets deals, evaluates operators, and helps investors build passive income

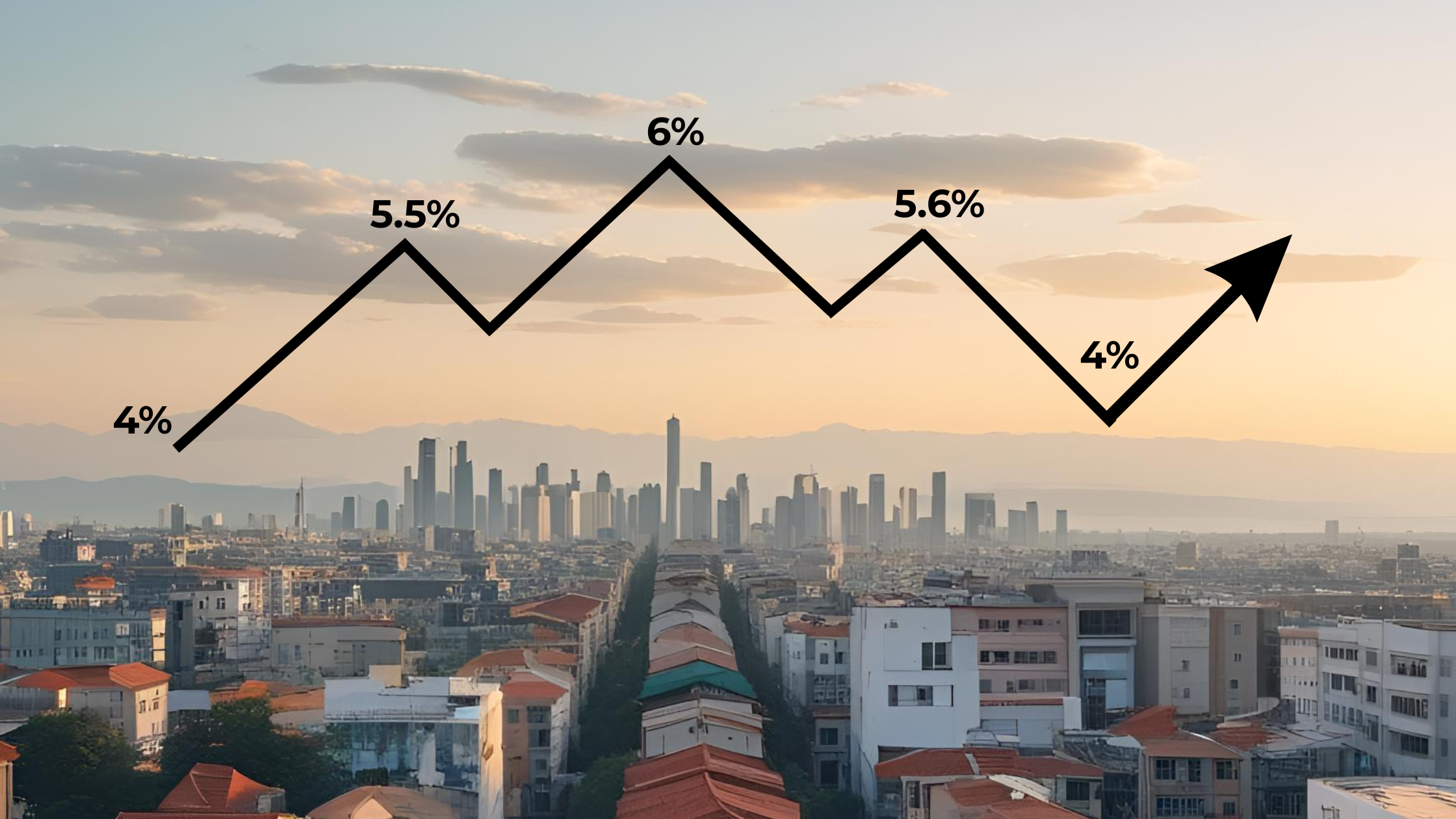

What is a Capitalization Rate in Real Estate

Learn about cap rates, how they are used in commercial real estate, and how investors should consider them when evaluating passive real estate investments.

Evaluating Real Estate Sponsors: The Role of Social Proof in Investment Decisions

This article explores the role of social proof in evaluating real estate sponsors, the risks of relying solely on past returns, and the dangers of influencer marketing in investment decision-making.

What is a Syndication Real Estate Investment?

A real estate syndication is a common investment structure that pools capital from multiple investors to acquire and manage larger commercial real estate assets.

Using AI, Community, and Transparency to Build a Better Investment Firm with TJ Burns

TJ Burns, founder of Burns Capital and ex-Amazon engineer, joins the Invest Clearly Podcast to break down the real challenges of raising capital and building long-term LP trust.